3 Utility Insights at DTECH

#3 Utility Insights at DTECH

I love living in Vermont and skiing through the winter, but wow, Distributech 2026 in San Diego was warm and sunny. What a venue, and what a welcome escape from the cold and snow.

This was my first conference on the vendor side, and after 13 years in utility operations, engineering, and technology, I’ve never felt more energized by the opportunity to improve both reliability and affordability. Utilities are facing more challenges than ever, from maintaining reliability to generation scarcity to rising operating costs.

What stood out to me, though, was the sheer number of vendors showcasing solutions like AI assistants, another wave of DERMS offerings, and the latest grid hardware. In many cases, it felt like the solutions had taken center stage while the underlying problems had faded into the background.

So instead of focusing on the vendors, I want to spend some time focusing on the challenges utilities are actually facing.

While vendors may dominate the show floor, DTECH is the place where we all get to see each other and connect. It’s full of utility engineers, operators, and program staff who genuinely care about maintaining reliability. The sessions reflected that. Most discussions centered on how to design and deploy reliable solutions, with less emphasis on affordability, though there was plenty of conversation about how demand response can help stabilize rates.

Across conversations and sessions, three themes kept coming up:

- Utilities want integrated data, not more standalone solutions

- Utilities want to move from DER programs to true DER operations

- Decentralized resilience solutions can deliver value faster than traditional infrastructure investments

#Utilities want integrated data not more solutions

Whether it’s outage management, SCADA, ADMS, dashboards, or DERMS, utilities are frustrated with how fragmented their environments have become. Years of point solutions have left operators juggling systems that don’t talk to each other, each answering a small part of the problem but never the whole one. Too often, the response from traditional vendors is to lock customers into an ever-expanding ecosystem: you don’t need common data layers or interoperability, you just need more of our products.

#Multiple Solutions, Same Problem

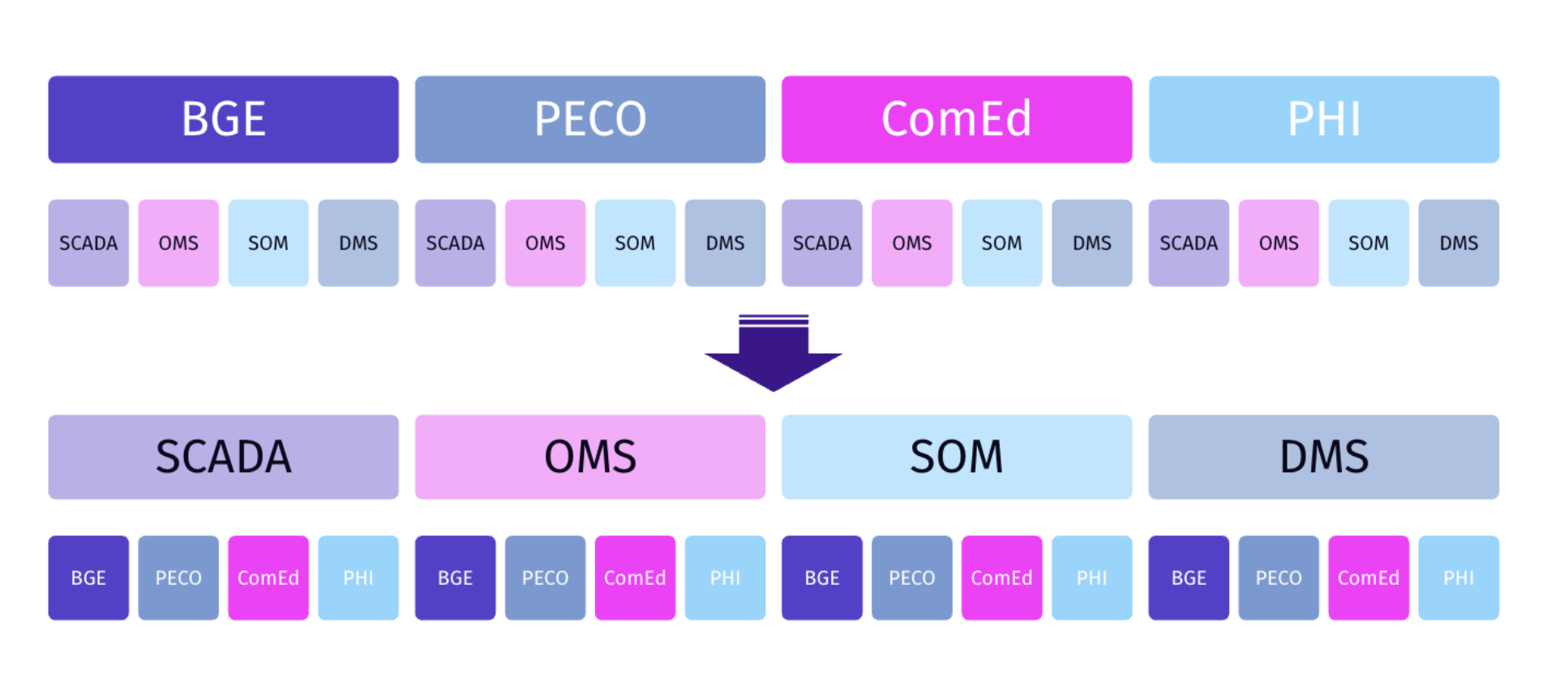

A good example came from the session Powering Innovation: Lessons from Testing a Multi-Utility ADMS Implementation. Several Exelon utilities shared this slide showing a unified approach across SCADA, OMS, switch order management, and DMS. The goal was clear: move away from each utility operating its own set of tools and toward a common software stack across the enterprise.

At a high level, that makes a lot of sense. From a vendor perspective (AspenTech), it’s especially attractive. But it doesn’t fully solve the problem. Standardizing on one vendor doesn’t magically fix the underlying data models. In many cases, it just replaces multiple disconnected systems with a single vendor’s set of dashboards. Operators don’t gain new insight or capability. They just get a cleaner UI on the same limitations.

#Proactive Data Alerting Still Falls Short

Another conversation that stuck with me was with someone at Dominion. At solar sites larger than 250 kW, they install power quality meters and protection and control via reclosers. This enables monitoring, provides a utility fail-safe, and supports direct transfer trip protection. The data flows into the control center through SCADA and into a historian so engineers can analyze historical events and anomalies.

On paper, this looks solid. In practice, it breaks down when something goes wrong. He shared that while most installers do a great job, they’ve encountered more than their fair share of sites with voltage setting issues. Given the existing architecture, there’s no proactive, real-time framework to surface those problems. Operators have to manually investigate.

The historian stores the data but doesn’t provide alerting out of the box, so Dominion has to build custom logic to detect power quality issues. SCADA and ADMS offer alerting, but they’re typically designed for substations and major customers, not thousands of distributed assets.

Grid DERMS platforms can help fill that gap, but most traditional solutions are disconnected from customer-facing AMI data. The result is a patchwork of tools that still don’t give operators or engineers a complete, actionable picture. Despite all the technology in place, utilities are left reacting instead of proactively managing the system.

#How Do Utilities Shift from DER Programs to DER Operations?

Matthew Chester wrote a great summary on Linkedin of what he heard at DTECH, noting a greater sense of urgency than ever around DER management and that “utilities are moving from tolerating DERs to unpacking how those resources can meet today’s needs.” From my perspective, utility program leads have been excited about batteries, thermostats, and other DERs for years. The value proposition has been clear for a long time.

What’s changing now is where that value needs to show up.

I sat in on a strong session from Electron Consumers and SMUD, Unlocking affordability with DERs: How utilities can turn distributed assets into trusted grid value. What came through clearly was the growing need to tightly integrate DER programs with utility infrastructure planning. Planners are increasingly viewing DERs as a real lever to address load growth and capacity constraints, not just as customer programs running in parallel.

Policy is reinforcing that shift. Several states have recently enacted requirements that infrastructure planners explicitly consider virtual power plants as a way to avoid or defer traditional investments, such as substation upgrades driven by load growth.

There was also a lot of discussion about how to identify and quantify DER value at the grid level. Utilities have spent years building demand response programs aimed at familiar use cases like generation capacity, peak demand reduction, and regional transmission needs. Using DERs to solve distribution-level challenges, such as transformer overloads or feeder constraints, is still relatively new territory.

#Utility Scale Progress, Behind the Meter Challenge

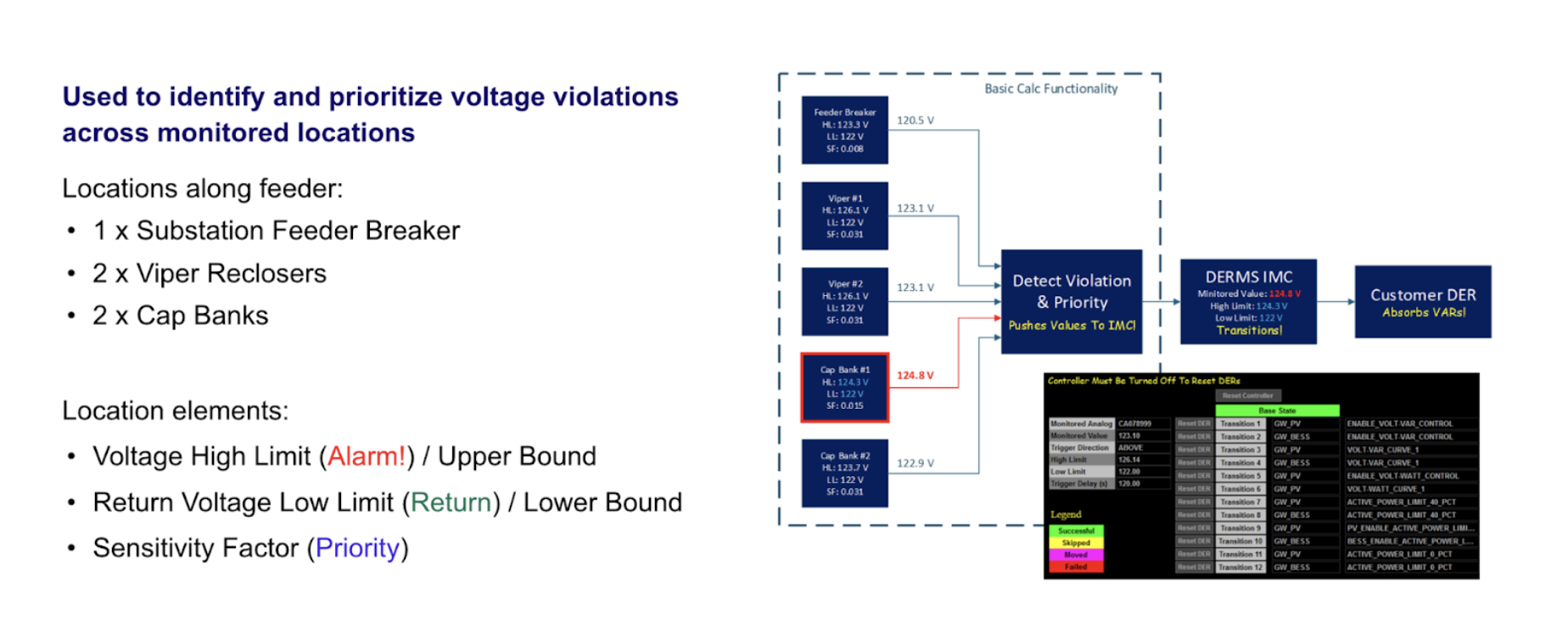

Imran Rahman from Exelon presented on how they’re managing voltage fluctuations caused by increased solar penetration and potential violations on distribution feeders when DERs are unevenly connected. He walked through how Exelon is using volt/var and volt/watt controls to manage new distributed solar interconnections, and it was a great example of utilities adapting to a more dynamic grid.

That approach works well for mitigating generation-driven issues on the distribution system, but it doesn’t yet address how customer-facing DERs can be used to relieve load constraints. There’s still a meaningful gap between grid-focused DERMS platforms built for utility-scale assets and edge DERMS solutions designed for behind-the-meter resources. When I asked Imran about behind-the-meter DERs, his answer was telling: they’re looking into it.

That feels representative of where much of the industry is today.

#Decentralized resilience solutions can deliver value faster than traditional infrastructure investments

Distributech has always been rooted in reliability. G&W and SEL showcased new utility hardware, meter vendors like Itron and Landis+Gyr highlighted expanded outage management capabilities, and AspenTech and GE Vernova rolled out the latest SCADA innovations. While much of today’s energy narrative focuses on cost mitigation and virtual power plants, what’s top of mind for operators is more immediate: managing the growing risks from wildfire, ice, and wind.

#Smaller , Lower Cost Batteries Provide Just as Much Resilience Value

I participated in a SEPA panel moderated by Mac Keller, with Florida Power & Light, and PG&E that focused on how distributed, non-wires solutions can improve customer resilience. A big takeaway was how quickly distributed batteries can be deployed compared to traditional infrastructure, while also delivering additional value streams like peak shaving.

In conversations with utility staff, there was growing interest in a newer generation of customer-side batteries from companies like Pila and Impulse Labs. These systems can be deployed without interconnection, which dramatically shortens timelines and lowers barriers.

While larger systems like Tesla’s Powerwall and Franklin’s aPower can provide whole-home backup, most customers are looking for something much simpler. Backing up a refrigerator, a Wi-Fi router, and a few critical loads often delivers the bulk of perceived resilience at a fraction of the cost.

#Fusing AMI, Grid Hardware with Distributed Sensing Is the Way

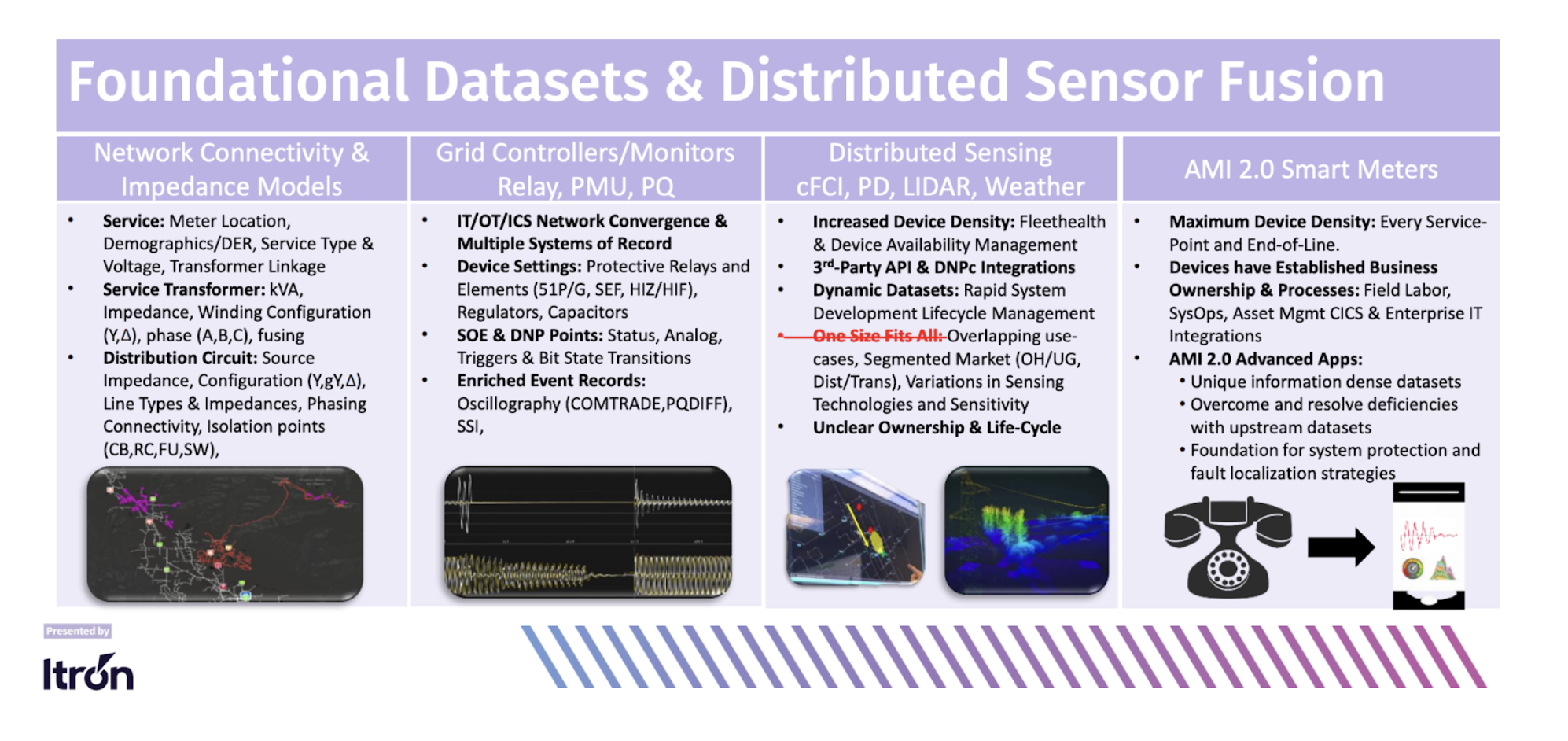

Sensor deployments and continued improvements in AMI are dramatically increasing the ability to predict, detect, and respond to outages. Southern California Edison, SDG&E, and PacifiCorp presented on Innovations in the Monitoring and Analysis of Distribution Systems to Improve reliability, Safety, and Reduce Risk of Wildfires and Major Storms. Their work highlighted the expanding set of data sources utilities can now draw from.

Combining sensors like Gridware with traditional utility assets such as reclosers and switches allows utilities to either detect conditions before an event occurs or respond far more quickly once it does. That same theme carried into a morning session on smarter outage management systems, which explored improving estimated times of restoration by incorporating outage type, location, field conditions, and other real-time data instead of relying on largely manual processes.

The challenge, once again, is integration. Existing OMS platforms don’t always support this level of connectivity, and utilities run into the same underlying issue: grid architecture built on fragmented data models. The technology is advancing quickly, but without tighter integration, much of its potential remains untapped.

#TLDR

If there was a common thread across DTECH, it was this: the tools exist, but the next phase of grid modernization will be defined by integration, operational execution, and how quickly utilities can turn distributed assets into real system value.